What is a Medicare Supplement – Medigap Plan?

Medigap plans were designed shortly after Medicare began in 1965 to cover deductibles, certain out of pocket expenses and the 20% that Medicare does not pay. These out of pocket costs can be financially devastating.

Some of the major advantages of Medigap a.k.a. Medicare Supplement policies are:

- You have the freedom to choose your own doctors, hospitals and other providers

- You never need referrals to see a specialists

- Nationwide access to any doctor or hospital that accepts Medicare

- Absolutely no claims paperwork.

- Guaranteed renewable for life as long as you pay the premium.

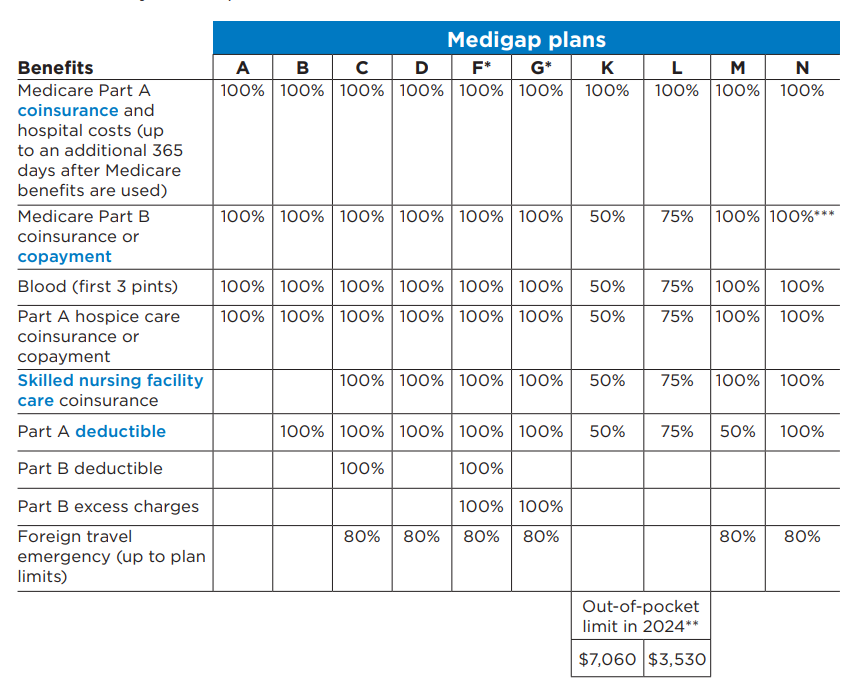

Medicare Supplement Standardized Plans

Medicare Supplement Insurance policies in Florida must be one of 10 standardized policies identified by Plan letters A through N. In addition, the standardized plans must offer the same basic benefits under that letter plan, no matter which company offers the plan.

* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 in 2024 before your policy pays anything. (You can’t buy Plans C and F if you were new to Medicare on or after January 1, 2020.

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($240 in 2024), the Medigap plan pays 100% of covered services for the rest of the calendar year.

***Plan N pays 100% of the Part B coinsurance. You must pay a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Florida Medigap Insurance policies for people under age 65 on Disability

Florida Medigap policies for people under age 65 and eligible for Medicare because of a disability or End-Stage Renal Disease (ESRD)

You may be eligible for a Medicare Supplement policy before the age 65 due to:

- a disability, or

- ESRD (permanent kidney failure requiring dialysis or a kidney transplant).

When Can I Enroll in a Medicare Supplement?

During your Medicare Initial Enrollment Period, which begins when you turn 65 and continues for 6 months, you are entitled to enroll in any Medicare Supplement or Medigap policy. At this time you cannot be turned down or rated up due to pre-existing conditions. This is referred to as your Guarantee Issue Period. During this period:

- You can buy certain Medicare Supplement/Medigap policies from private insurance companies that offer plans in your State.

- Insurance companies can’t refuse to sell you a policy due to a disability.

- They cannot charge you a higher premium because of your health status.

- They are not allowed to charge you a higher premium than they charge other people who are age 65.

At National Insurance Services of North America (NISONA) we are committed to your total satisfaction. We offer a truly unbiased approach and practical solutions to help you find a plan that will most suit your needs and budget. Medicare is not one size fits all.

Give us a call and we will help you to explore your options and answer any questions you may have. You are under no obligation.

Our goal? “Peace of mind to last you a lifetime!”

Nisona serves the insurance needs of the Treasure and Space Coast.